Title: Understanding China's Property Market Regulation (317 Policy)

Introduction

In recent years, China's property market has been subject to significant government regulation, including the widely discussed "317 Policy." This policy encompasses various measures aimed at controlling speculation, stabilizing housing prices, and promoting sustainable development in the real estate sector. Understanding the intricacies of the 317 Policy is crucial for investors, homebuyers, and real estate professionals alike. Let's delve into the key aspects of this policy and its implications.

Overview of the 317 Policy

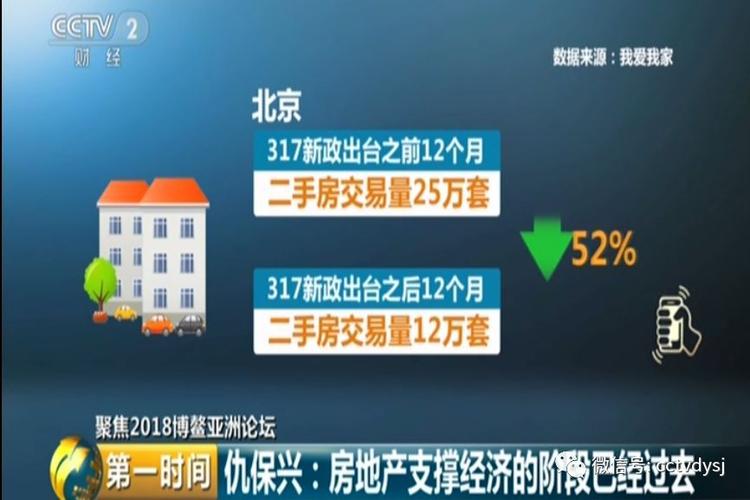

The "317 Policy" refers to a series of measures introduced by the Chinese government on March 17th (hence the name) to regulate the real estate market. These measures primarily focus on curbing speculation, controlling housing prices, and ensuring the healthy development of the property sector.

Key Components of the 317 Policy

1.

Purchase Restrictions

: One of the central elements of the 317 Policy is the imposition of purchase restrictions in certain cities. These restrictions typically include limits on the number of properties an individual or household can purchase, higher down payment requirements for second or third homes, and stricter eligibility criteria for nonlocal buyers.2.

Credit Policies

: The government has also tightened lending policies to discourage speculative buying. This includes raising mortgage rates, increasing the required down payment for home purchases, and limiting the availability of credit for real estate investment purposes.3.

Land Supply Management

: To prevent excessive land speculation and promote sustainable urban development, local authorities have been instructed to control the supply of land for residential purposes. This involves more stringent approval processes for land sales and a focus on developing affordable housing projects.4.

Taxation Measures

: Tax policies play a crucial role in the 317 Policy framework. Governments have implemented measures such as property tax trials in select cities, higher transaction taxes on real estate transactions, and penalties for property hoarding or speculative activities.5.

Market Monitoring and Enforcement

: Regulatory bodies have stepped up monitoring and enforcement efforts to ensure compliance with the 317 Policy. This includes scrutinizing property developers, real estate agencies, and financial institutions for any violations of regulations or attempts to circumvent policy measures.Implications and Guidance

1.

Impact on Investors

: Investors in the real estate market need to adapt their strategies to comply with the new regulatory environment. Longterm investment horizons, focusing on highquality properties in prime locations, and diversifying investment portfolios beyond real estate can help mitigate risks.2.

Considerations for Homebuyers

: Prospective homebuyers should carefully assess their financial situation and affordability in light of stricter lending policies and higher down payment requirements. Moreover, understanding local purchase restrictions and market dynamics is essential for making informed buying decisions.3.

Role of Real Estate Professionals

: Real estate agents and agencies play a crucial role in guiding clients through the complexities of the 317 Policy. They must stay updated on the latest regulations, provide transparent information to clients, and offer professional advice tailored to individual needs and circumstances.4.

Longterm Outlook

: While the 317 Policy may create shortterm challenges for the property market, it aims to foster a more stable and sustainable real estate sector in the long run. Investors and stakeholders should maintain a longterm perspective and adapt their strategies accordingly.Conclusion

China's 317 Policy reflects the government's commitment to ensuring the stability and healthy development of the property market. By implementing measures to curb speculation, control housing prices, and promote sustainable growth, policymakers seek to maintain social stability and address concerns about housing affordability. Stakeholders in the real estate sector must stay informed about the evolving regulatory landscape and adjust their strategies to navigate the market effectively. Through prudent decisionmaking and adherence to regulatory requirements, investors, homebuyers, and real estate professionals can navigate the challenges and opportunities presented by the 317 Policy.